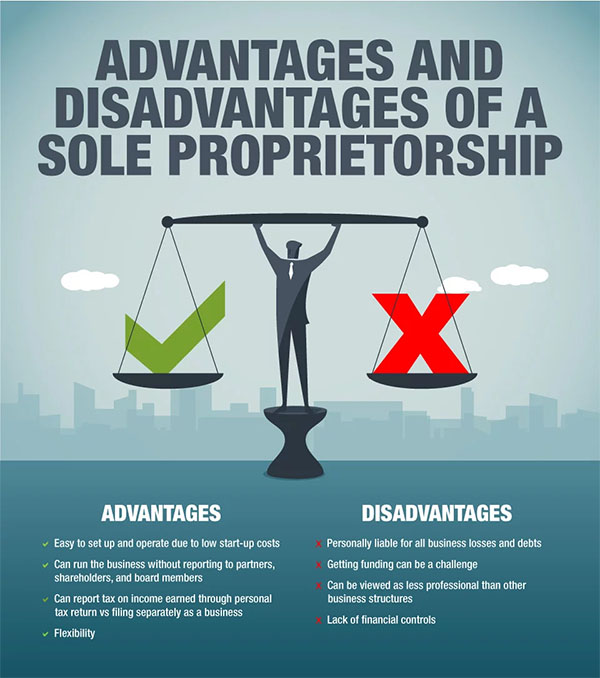

When starting a small business, there are many things that you are going to have to consider and important decisions you’ll have to make in order to get your business up and running. One of these decisions that you won’t want to take lightly is choosing a legal structure. As a small business owner, there …

Continue reading How Do I Choose a Legal Structure for My Small Business?