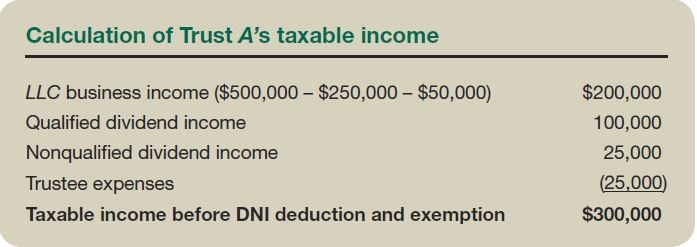

The enactment of Sec. 199A provides one more reason to advise clients to create separate trusts for individual beneficiaries instead of a single trust. A single trust for the benefit of all the children may seem fair and less expensive when children are young. However, different ages, family size, economic status, and risk tolerance can …