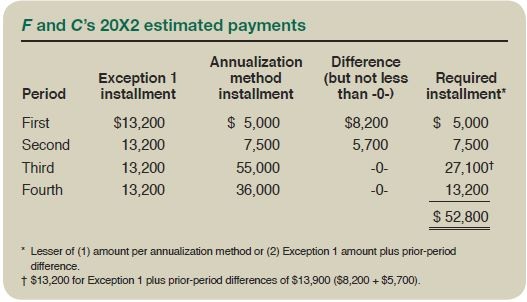

Taxpayers must pay their taxes throughout the year either through payroll withholding or by making quarterly estimated payments; otherwise, tax underpayment penalties are assessed. However, underpayment penalties are avoided if any of the following situationsapply: Small balance due after federal income tax withholding: The tax, after reducing it for federal income tax withheld, is less …

Continue reading Strategies for minimizing estimated tax payments